A wave of startups is changing finance—for the better

IN THE years since the crash of 2007-08, policymakers have concentrated on making finance safer. Regulators have stuffed the banks with capital and turned compliance from a back-office job into a corner-office one. Away from the regulatory spotlight, another revolution is under way—one that promises not just to make finance more secure for taxpayers, but also better for another neglected constituency: its customers.

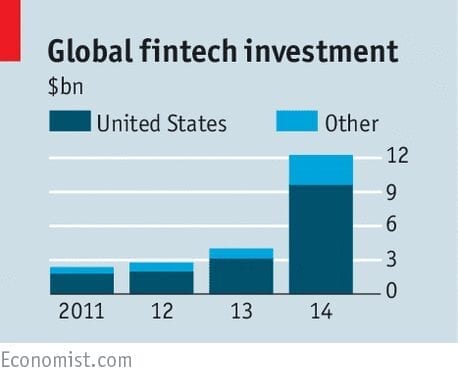

The magical combination of geeks in T-shirts and venture capital that has disrupted other industries has put financial services in its sights. From payments to wealth management, from peer-to-peer lending to crowdfunding, a new generation of startups is taking aim at the heart of the industry—and a pot of revenues that Goldman Sachs estimates is worth $4.7 trillion. Like other disrupters from Silicon Valley, “fintech” firms are growing fast. They attracted $12 billion of investment in 2014, up from $4 billion the year before. Many of these businesses are long past the experimental phase, as our special report this week explains. Lending Club and OnDeck, two new lenders, have gone public; users of Venmo, a payments app, transferred $1.3 billion last quarter. In his latest annual letter to shareholders Jamie Dimon, the boss of JPMorgan Chase, warned that “Silicon Valley is coming.”

The fintech firms are not about to kill off traditional banks. The upstarts are still tiny: Lending Club has arranged $9 billion in loans through its marketplace, small change compared with $885 billion of total credit-card debt in America. They have yet to be properly tested in a downturn. No fintech product comes close to matching the convenience and security of a current account at a bank. And banks will gain from many of the innovations. Square, for instance, is a system that makes it easier for small businesses to take card payments; it will boost banks’ transaction volumes. Nonetheless, the fintech revolution will reshape finance—and improve it—in three fundamental ways.

First, the fintech disrupters will cut costs and improve the quality of financial services. They are unburdened by regulators, legacy IT systems, branch networks—or the need to protect existing businesses. Lending Club’s ongoing expenses as a share of its outstanding loan balance is about 2%; the equivalent for conventional lenders is 5-7%. That means it can offer better deals to the borrowers and lenders who congregate on its platform. Half of the loan applications Funding Circle gets from small businesses arrive outside normal business hours. TransferWise takes a machete to the hefty fees that banks levy to send money across borders.

Read more: The fintech revolution

The Latest on: Fintech

[google_news title=”” keyword=”Fintech” num_posts=”10″ blurb_length=”0″ show_thumb=”left”]

via Google News

The Latest on: Fintech

- I'm More Excited About This Fintech Stock Than Ever Before -- Here's Whyon May 1, 2024 at 3:03 am

In this video, I'll discuss the numbers that made me extremely happy, and why I'm a buyer of this fintech leader at these levels. *Stock prices used were the afternoon prices of April 30, 2024. The ...

- New Norfolk fintech cluster could be worth £100 million by 2027on May 1, 2024 at 1:17 am

The Norfolk FinTech Report 2024 – commissioned by Tech East and independently produced by Whitecap Consulting – forecasts Norfolk’s FinTech sector could be worth £100M by 2027, with the number of ...

- Nigeria restricts fintech onboarding to stop KYC-evading crypto investorson April 30, 2024 at 5:00 pm

The Central Bank of Nigeria (CBN) directed four fintech companies to stop onboarding new customers amid Nigeria’s ongoing efforts to strengthen Know Your Customer (KYC) compliance in crypto and ...

- Rep. Hill takes aim at Biden administration's moves on fintechon April 30, 2024 at 3:15 pm

Rep. French Hill, the No. 2 Republican on the House Financial Services Committee, promised bankers Tuesday that he will continue to push back against Biden administration regulators, especially on ...

- Fintech Blend raises millions to refinance debton April 30, 2024 at 2:11 pm

Blend's co-founder said a private equity firm's $150 million investment in the company is a vote of confidence.

- Bankrupt Etta restaurants bought for $4 million by Texas fintech entrepreneur, who plans to grow the brandon April 30, 2024 at 11:28 am

A Texas financier has purchased the bankrupt Etta restaurant group for $4 million, with plans to expand the Chicago brand nationwide. Johann Moonesinghe, 41, CEO and co-founder of Austin-based ...

- UNF to offer new fintech graduate and undergraduate programson April 30, 2024 at 8:28 am

Starting this fall, the University of North Florida will offer both graduate and undergraduate programs in FinTech, strengthening the talent pipeline that fuels Jacksonville as a booming financial ...

- 2024 mobile trends in the Fintech industryon April 30, 2024 at 4:24 am

In the ever-evolving world of mobile technology, 2024 is set to form the backdrop to a number of exciting developments and advancements within the digital sector.

- 3 Negotiation Essentials To Maximize Your Next Fintech Pay Packageon April 30, 2024 at 12:49 am

This is a list of what you can negotiate on when accepting your next fintech job. These items go beyond the salary itself to maximise your pay, way of life and savings ...

- Stripe's big changes, Brazil's newest fintech unicorn and the tale of a startup shutdownon April 28, 2024 at 11:40 am

Stripe announced that it will be de-coupling payments from the rest of its financial services stack. This is a big change, considering that in the past, even as Stripe grew its list of services, it ...

via Bing News