A new IIASA study proposes a solution for mitigating the increasingly risky nature of financial markets, based on an analysis of systemic risk in financial networks.

A tax on individual transactions between financial institutions—based on the level of systemic risk that each transaction adds to the system—could essentially eliminate the risk of future collapse of the financial system, according to a new study published in the journal Quantitative Finance. It relies on an analysis of the networks of the banking system, using central bank data from Austria.

“When banks collapse, it costs a lot to bail them out, and that money usually comes from the public, from taxpayers” explains IIASA researcher Stefan Thurner, who coauthored the study with IIASA researcher Sebastian Poledna. The proposed tax would go into a government fund which could be used to bail out a struggling bank, for example. “You could also consider it a form of systemic risk insurance,” says Thurner.

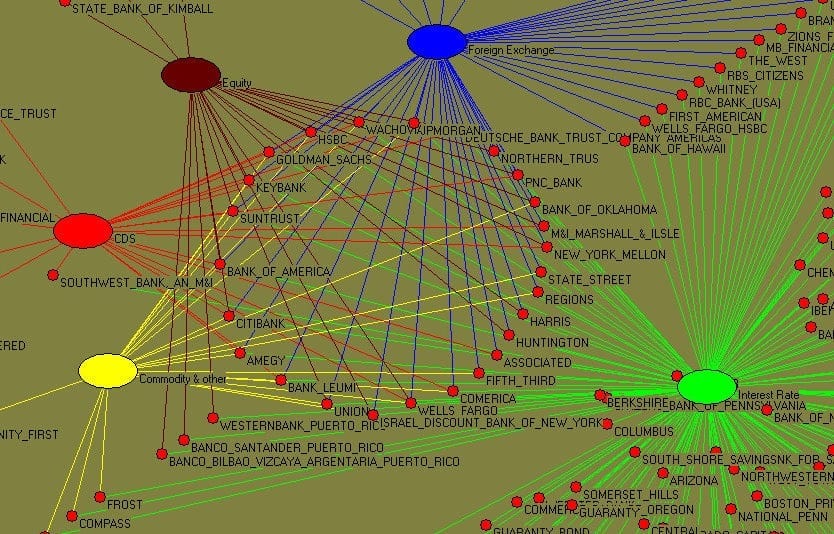

Financial institutions are linked by multiple types of transactions, which Thurner and Poledna have modeled in a detailed network analysis. These transactions include deposits and loans between financial institutions. The study is the first to quantify the systemic risk that individual transactions add to the system.

“Since the international financial crisis in 2007 and 2008, policymakers have been discussing new ways to regulate the system in order to help avoid a repeat scenario. The new study provides just that,” says Poledna. While introducing such a tax would require some work, the researchers argue that the data are there and the technical effort required for implementation is not overwhelming. Thurner has already presented the work to interested policymakers, supervisors, and central banks in the EU and Mexico.

“There’s currently a lot of discussion about a Tobin tax in the European Union, but the version they are proposing would tax every transaction at a flat rate. The tax we are proposing would not have to be large, in order to act as an incentive scheme for avoiding transactions that would be the most harmful for the system—banks would try to avoid transactions that generate that risk,” says Thurner.

Learn more: Intelligent transaction tax could help reduce systemic risk in financial networks

The Latest on: Intelligent transaction tax

[google_news title=”” keyword=”Intelligent transaction tax” num_posts=”10″ blurb_length=”0″ show_thumb=”left”]

via Google News

The Latest on: Intelligent transaction tax

- Informatica Reports First Quarter 2024 Financial Resultson May 1, 2024 at 9:05 am

Adjusted Unlevered Free Cash Flow (after-tax) of $183.0 million ... Processed 91.8 trillion cloud transactions per month for the quarter ended March 31, 2024, as compared to 54.3 trillion cloud ...

- CCC Intelligent Solutions Holdings Inc. Announces First Quarter 2024 Financial Resultson April 30, 2024 at 3:28 pm

CCC Intelligent Solutions Holdings Inc. (“CCC” or the “Company”) (NASDAQ: CCCS), a leading cloud platform for the P&C ...

- Best Online Brokerages for Beginners in May: A 2024 Guideon April 30, 2024 at 10:56 am

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. Start your search now. The offers and details on this page may have updated or changed ...

- Best Custodial Accounts of May 2024: A Comprehensive Guideon April 30, 2024 at 8:38 am

Custodial accounts, or UGMA/UTMA accounts, are brokerage accounts that allow parents or guardians to invest on behalf of their children or dependents. Ownership of these accounts transfers to the ...

- Eaton Reports Record First Quarter 2024 Results, with Strong Orders and Backlog Growthon April 30, 2024 at 3:37 am

Intelligent power management company Eaton Corporation plc (NYSE:ETN) today announced that earnings per share were $2.04 for the first quarter of 2024, a first quarter record and up 28% over the first ...

- Lantronix Reports Record Revenue for Third Quarter of Fiscal 2024on April 29, 2024 at 1:18 pm

Net Revenue of $41.2 Million, up 11 Percent Sequentially and up 25 Percent Year-Over-YearThird Quarter GAAP EPS of ($0.01) vs.

- Understanding Taxes on Mutual Funds Dividendson April 24, 2024 at 5:00 pm

While this can be simple and effective in increasing your regular earnings, it's important to understand the tax implications ... timing of their mutual fund transactions. Those who wish to ...

- We need to return to win-win thinkingon April 21, 2024 at 8:00 pm

One powerful concept from economic theory is the idea of a “positive-sum gain” or, as Stephen Covey put it, the “win-win.” In contrast, negative-sum thinking — a feature of populism — encourages us to ...

- 10 Savvy Ways To Invest Your Tax Refund In 2024on April 16, 2024 at 1:59 pm

Wondering what to do with your tax refund? Consider investing with it. Check out our list of savvy ways to invest your tax refund.

- Can You Write Off Crypto Losses On Your Taxes?on January 19, 2023 at 7:44 am

The CPA adds that Intelligent Tax Optimization takes the work out of tracking down missing and accurate cost basis values and "assures accurate reporting of capital gains and losses by importing ...

via Bing News