IN AN INCREASINGLY INTERCONNECTED WORLD, THE ACTIONS OF THE FEW CAN RAPIDLY SPIRAL INTO A GLOBAL CRISIS

POLICYMAKERS MUST LEARN FROM RECENT EVENTS TO CONTROL THE RISK LATENT IN OUR INTERDEPENDENCE.

Many of the greatest challenges of the 21st century are not new. These include the elimination of poverty and disease, the avoidance of conflict and nuclear proliferation, and the loss of biodiversity and natural resources. What is new is the nature of interdependence and complexity, as more integration among an increased number of people, combined with new technology, has led to greater fragility and the creation of a global risk society. The financial crisis is only the first part of the 21st century systemic crisis to manifest. It is vital that we learn from it in order to manage deeper and more damaging global challenges, such as climate change and global pandemics, and to avoid a destabilizing cycle of more acute financial crises.

Systemic risk is the underbelly of globalization and technical change. Intense integration of markets, trade, and finance has accompanied the latest tidal wave of globalization, facilitated by seismic policy shifts, like those associated with the fall of the Soviet Union, the formation of the European Union, and the opening of emerging economies. Between 1980 and 2005, global foreign-investment flows increased 18 times, and trade flows increased more than sevenfold, reflecting unprecedented integration.

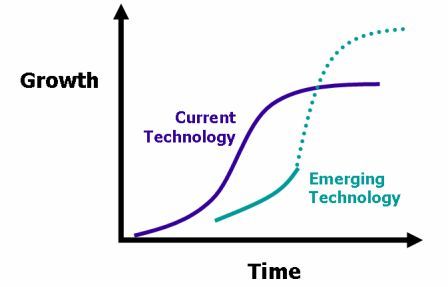

Technological innovation has also spurred economic integration. The development of fiber optics, the internet, and mobile telephony, as well as exponential growth in computing power have virtually increased proximity. Physical proximity has also increased through technological innovation in transport and infrastructure, and the world’s urban population has increased dramatically, from 29 percent in 1950 to over 50 percent in 2009, as total population has doubled.

This global integration has been associated with unprecedented leaps in human-development indicators. However, risks arising from interdependency and complexity threaten to undermine and overwhelm the benefits of globalization. Systemic risks, which can lead to breakdowns in an entire system, are a growing hazard.

While the term “systemic risk” has historically referred mainly to collapses in finance, recent decades of globalization have created new and broader risks. There has been an exponential increase in the number of nodes and pathways through which materials, capital, information, and knowledge can be transmitted at lightning speeds and with global reach. These networks also have the potential to create and propagate risk. Interconnectedness, networks’ central property, can lead simultaneously to greater robustness and more fragility. Risk can decline as connectivity increases because as risk sharing increases, so does the number of nodes and links. This is true of financial systems, manufacturing services, intellectual property, and ecosystems. However, increased fragility is also a concern. Once a tipping point is triggered past its threshold, connectivity can amplify and spread risk instead of sharing it stably.

These new vulnerabilities challenge the very core of the benefits that globalization has produced, posing a fundamental challenge to global leaders and international institutions. Neither the present institutional structure nor currently planned reforms are fit for the challenge, as they fail to reflect the underlying threat of systemic risk.

The conditions that led to the financial crisis can serve as a lesson as we move forward in this era of interconnectedness and rapid technical change.