The research is delivered as a warning to asset managers, shareholders and bankers

Call it an act of the greatest folly, or simply one of greed. But it seems that the world’s energy companies are hell-bent on spending up to $6 trillion of shareholder funds and bank debt in the next decade on fossil fuel investments – assets that could well become stranded and worthless if the world acts to limit climate change.

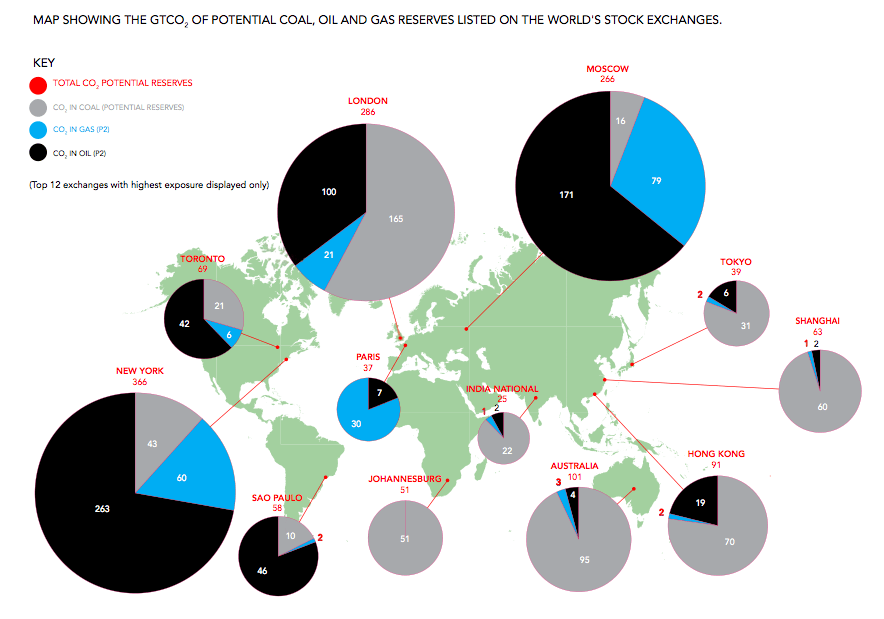

This is the conclusion of a new report on the so-called “Carbon Bubble”, which highlights the fact that the bubble is getting bigger. It now estimates that between 60 and 80 per cent of the coal, oil and gas reserves of publicly listed companies could be classified as unburnable if the world is to achieve emissions reductions that offer the greatest chance of limiting average global warming to 2°C.

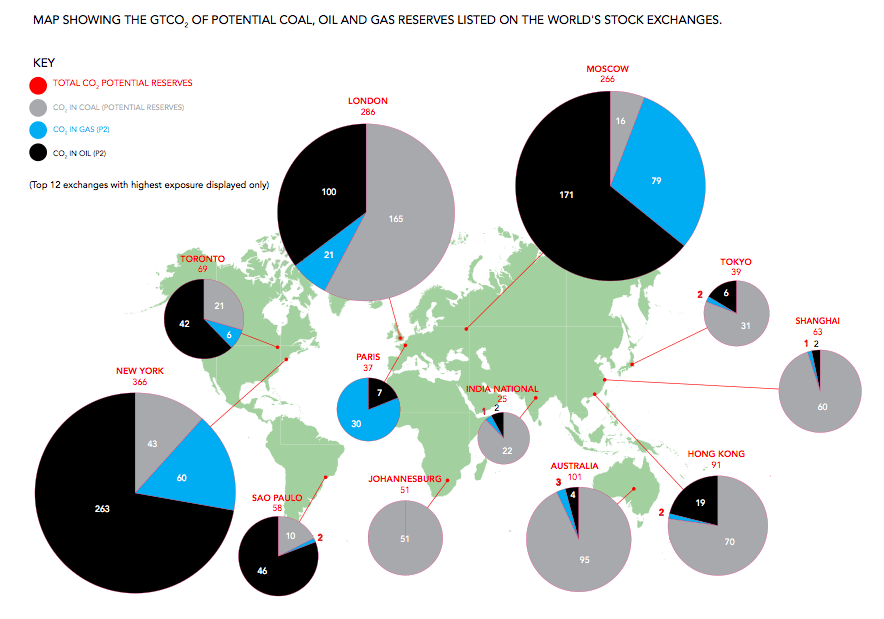

Research by Carbon Tracker and the Grantham Research Institute on Climate Change and the Environment at London School of Economics and Political Science shows that 200 major listed companies own 762 billion tonnes of carbon dioxide (CO2) through their reserves of coal, oil and gas. These reserves currently supports share value of $4 trillion and service $1.5 trillion in outstanding corporate debt.

But to achieve emissions reductions consistent with an 80 per cent chance of achieving the 2°C target, the fossil fuel reserves of these listed companies would likely have to comply with a budget of just 125 billion tonnes to 275 billion tonnes of CO2. That means cutting them by three quarters or more, even more than that estimated last year by the International Energy Agency.

To make matters worse, a further $674 billion was invested in new fossil fuel investments in 2012, and at the current rate more than $6 trillion will be invested over the coming decade – much, or even all of which could become stranded assets.

The research is delivered as a warning to asset managers, shareholders and bankers, but it comes in the same week that the principal market signal on climate change action, the international carbon price, plunged to new lows in Europe after the failure of the EU parliament to solve the damaging impact of a huge surplus of free and unused carbon credits.

The collapse of the carbon price is being painted as a failure of the market based system, when in fact it is really a failure of political will. In Australia, true to form, the mainstream media has been led by the political spin-doctors to focus on what amounts to economic trivia – the impact that a lower carbon price could have on forward estimates of budget revenues.

The larger and most significant implications, that of the need for companies to have an incentive to invest in action to decarbonise one of the world’s most emissions-intensive economies, is largely ignored. And don’t think that corporate Australia is not stupid enough to ignore what is clearly one of the key global mega-trends. The speech by Tony Shepherd, the chair of the Business Council of Australia, was confirmation of that – recognizing that Australia’s response to climate change was somewhere between “half-hearted and non-existent”, but at the same time calling on the government to effectively dismantle the very schemes that encourage the required investment.

Too many in corporate Australia will use any excuse to avoid the inevitable, in the interest of short term returns, and this has become the de-facto policy of the Coalition government-in-waiting, which has upped its calls to scrap the whole idea of a carbon price. Analysts say this is a really bad idea, even if you are supposedly concerns about short term “competitiveness.” It was interesting that Chinese authorities were making clear overnight that the European price collapse would have no impact on its own plans for an ETS.

The Carbon Tracker research may appear dramatic, but the concept of a carbon bubble is steadily gaining traction among funds managers, analysts, and advisors. Apart from the IEA clarion call last year, Citi last month reached a similar conclusion about the potential impact of concerted climate action, depending on its timing. It noted that fossil fuel companies would be motivated to extract their assets as quickly as possible – an action that the BCA seems happy to endorse, and facilitate.

Professor Lord Stern of Brentford, chair of the Grantham Research Institute on Climate Change and the Environment, and he of the eponymous report on climate economics, said smart investors can already see that most fossil fuel reserves are essentially unburnable because of the need to reduce emissions in line with the global agreement by governments to avoid global warming of more than 2°C.

“They can see that investing in companies that rely solely or heavily on constantly replenishing reserves of fossil fuels is becoming a very risky decision. But I hope this report will mean that regulators also take note, because much of the embedded risk from these potentially toxic carbon assets is not openly recognized through current reporting requirements.”

Stern said that the report raises serious questions as to the ability of the financial system to act on industry-wide long term risk, since currently the only measure of risk is performance against industry benchmarks.

Paul Spedding, an oil and gas analyst at HSBC, said described the scale of unburnable carbon assets in listed companies as “astonishing”, and added ‘business-as-usual’ is not a viable option for the fossil fuel industry in the long term.

“Management should already be looking to new business models that reduce the risk of stranded assets destroying shareholder value, In future, capital allocation should emphasise shareholder returns rather than investing for growth,” he said

Jens Peers, chief investment officer for Sustainable Equities

at MIROVA, was even more damming. “It is still shocking to see the numbers, as they are worse than people realise. It is frightening that risk is not properly distributed and this needs to be cleaned up.”

The Latest Bing News on:

Carbon bubble

- Super-Earth Exoplanet 55 Cancri e (Artist’s Concept) (IMAGE)on May 8, 2024 at 9:42 am

This artist's concept shows what the exoplanet 55 Cancri e could look like based on observations from NASA’s James Webb Space Telescope and other observatories. Observations from Webb’s NIRCam and ...

- NASA’s Webb hints at possible atmosphere surrounding rocky exoplaneton May 8, 2024 at 9:01 am

or carbon monoxide (CO). Researchers think the gases that make up the atmosphere could have bubbled out of an ocean of magma that is thought to cover the planet’s surface. Researchers using NASA’s ...

- Carbon Marketson May 8, 2024 at 2:52 am

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial ...

- New Net-Zero Library Breaks Ground in Waterloo Regionon May 7, 2024 at 7:11 am

Libraries have long been a place of creative and professional growth, and a new branch of the Kitchener Public Library, which broke ground last October, is no exception.

- Pushing the bubble further in personal cleansingon May 7, 2024 at 4:57 am

At the forefront of beauty innovation, prepare to be captivated by Clariant’s latest personal care star hitting the North American market: GlucoTain GEM ...

- Novo Helix T50 Carbon Fiber Tripod Kit reviewon May 4, 2024 at 2:37 pm

G ood things come in small packages, and the Novo Helix T50 is a prime example. Packing down to just 35.5cm, with the legs wrapped neatly around the head, it extends to a decent, if unremarkable, ...

- 5 tips to shop more sustainably onlineon May 3, 2024 at 10:21 am

Love the convenience of clicking “place your order” but concerned about the environmental impact? Here are some ideas to be a more thoughtful online shopper.

- Why cracking your knuckles is so satisfying—and if it’s really a bad habiton May 3, 2024 at 9:44 am

Your friends and family may have told you knuckle cracking is bad for you. But is it really as harmful as some might think?

- Zoogeochemists measure how animals change the chemistry of their environmentson May 2, 2024 at 6:27 pm

including the consumption of oxygen and the purging of carbon from the ecosystem as carbon dioxide and methane are generated and bubble off into the atmosphere. Using sensors and water samples from 20 ...

- Toward artificial leaves that float on water, bubbling fuelon May 2, 2024 at 2:14 pm

Researchers have now made such an artificial leaf device using an organic photovoltaic (OPV) material. Depending on the catalyst used, the device either splits water to make hydrogen fuel or splits ...

The Latest Google Headlines on:

Carbon bubble

[google_news title=”” keyword=”Carbon bubble” num_posts=”10″ blurb_length=”0″ show_thumb=”left”] [/vc_column_text]The Latest Bing News on:

Fossil fuel investments

- Temple Student Government endorses university fossil fuel divestmenton May 8, 2024 at 4:48 pm

The statement, made in conjunction with Temple Climate Action, calls for the university to be transparent about its financial investments in fossil fuels.

- Fossil fuel tax needed to power shift to renewable energy: Rod Simson May 8, 2024 at 10:55 am

Former ACCC head Rod Sims says Australia could supply 10 per cent of the world’s renewable energy but will need to impose a fossil fuel tax to fund the required investment. Mr Sims told the second ...

- Clean energy on the cusp of rolling back fossil fuels: Reporton May 8, 2024 at 7:40 am

Solar and wind investments reach tipping point in electricity supply, spelling doom for coal and gas, says think tank.

- Responsible Travel cuts ties with Barclays over fossil fuel investmentson May 8, 2024 at 4:51 am

Activist operator’s new-look leadership team calls on industry to ’divest’ from banks and energy suppliers investing in fossil fuels ...

- U.S. Achieves Unprecedented Energy Independence Amid Global Conflictson May 8, 2024 at 12:49 am

The analysis by Michael Cembalest, the chair of the market and investment strategy at J.P. Morgan, highlights a milestone where the U.S. has emerged as a net exporter of fossil fuels, contributing ...

- 'End fossil fuel funding' implore Imperial studentson May 7, 2024 at 11:44 pm

Students call on Imperial College London to end all fossil fuels investments from its £542 million endowment - as university finance becomes a global flashpoint.

- EPA Finalizes Rules to Regulate Pollution from Fossil Fuel-Fired Power Plantson May 7, 2024 at 5:00 pm

the Environmental Protection Agency ("EPA") finalized four rules to regulate pollution from fossil fuel-fired power plants. EPA's stated goal was to provide a framework on which power plants can rely ...

- Clean energy ETFs start to outperform key oil & gas ETFon May 7, 2024 at 8:49 am

After a rough couple of years, exchange-traded funds (ETFs) tied to clean energy generation and distribution are starting to outperform investor vehicles centred on oil and gas exploration and ...

- Opinion: California pensions’ investments in fossil fuels are not only futile, but dangerouson May 2, 2024 at 12:30 pm

Divesting from fossil fuels companies would protect frontline communities, state workers and ultimately our planet.

- Why won’t Freeland rule out fossil fuels in clean investment definitions?on May 2, 2024 at 2:15 am

Finance Canada is undermining sustainable investment with a multi-year effort to include fossil fuels in guidelines intended to help capital flow to clean alternatives, climate and finance experts say ...

The Latest Google Headlines on:

Fossil fuel investments

[google_news title=”” keyword=”fossil fuel investments” num_posts=”10″ blurb_length=”0″ show_thumb=”left”]