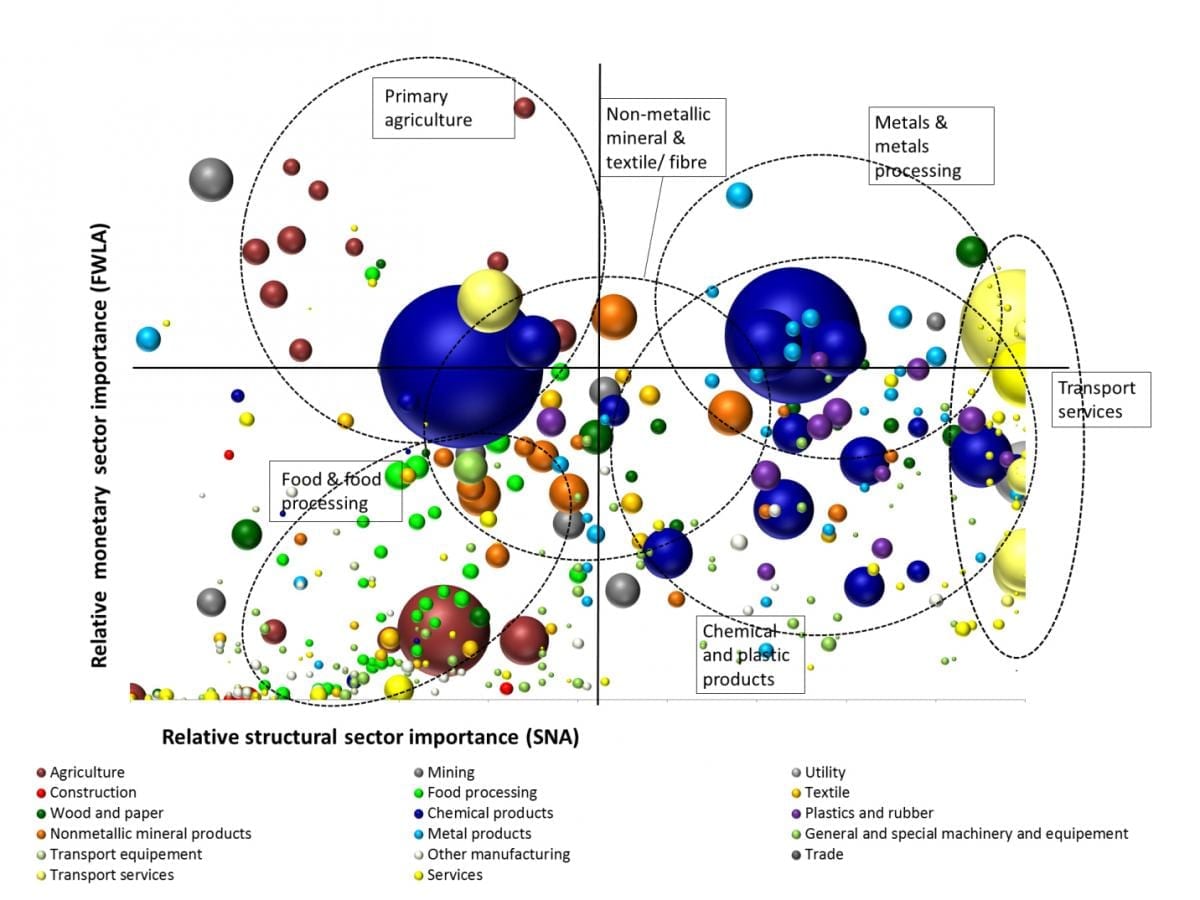

The figure above shows sectors’ importance and vulnerability to Peak Oil. The bubbles represent sectors. The size of the bubbles visualizes the vulnerability of a particular sector to Peak Oil according to the expected price changes; the larger the size of the bubble, the more vulnerable the sector is considered to be. The X axis shows a sector’s importance according to its contribution to GDP and on the Y axis according to its structural role. Hence, the larger bubbles in the top right corner represent highly vulnerable and highly important sectors. In the case of Peak Oil induced supply disruptions, these sectors could cause severe imbalances for the entire U.S. economy.

Could put the entire U.S. economy at risk when global oil production peaks (“Peak Oil“)

Researchers from the University of Maryland and a leading university in Spain demonstrate in a new study which sectors could put the entire U.S. economy at risk when global oil production peaks (“Peak Oil”). This multi-disciplinary team recommends immediate action by government, private and commercial sectors to reduce the vulnerability of these sectors.

While critics of Peak Oil studies declare that the world has more than enough oil to maintain current national and global standards, these UMD-led researchers say Peak Oil is imminent, if not already here—and is a real threat to national and global economies. Their study is among the first to outline a way of assessing the vulnerabilities of specific economic sectors to this threat, and to identify focal points for action that could strengthen the U.S. economy and make it less vulnerable to disasters.

Their work, “Economic Vulnerability to Peak Oil,” appears in Global Environmental Change. The paper is co-authored by Christina Prell, UMD’s Department of Sociology; Kuishuang Feng and Klaus Hubacek, UMD’s Department of Geographical Sciences, and Christian Kerschner, Institut de Ciència i Tecnologia Ambientals, Universitat Autònoma de Barcelona. Read the article.

A focus on Peak Oil is increasingly gaining attention in both scientific and policy discourses, especially due to its apparent imminence and potential dangers. However, until now, little has been known about how this phenomenon will impact economies. In their paper, the research team constructs a vulnerability map of the U.S. economy, combining two approaches for analyzing economic systems. Their approach reveals the relative importance of individual economic sectors, and how vulnerable these are to oil price shocks. This dual-analysis helps identify which sectors could put the entire U.S. economy at risk from Peak Oil. For the United States, such sectors would include iron mills, chemical and plastic products manufacturing, fertilizer production and air transport.

“Our findings provide early warnings to these and related industries about potential trouble in their supply chain,” UMD Professor Hubacek said. “Our aim is to inform and engage government, public and private industry leaders, and to provide a tool for effective Peak Oil policy action planning.”

Although the team’s analysis is embedded in a Peak Oil narrative, it can be used more broadly to develop a climate roadmap for a low carbon economy.

“In this paper, we analyze the vulnerability of the U.S. economy, which is the biggest consumer of oil and oil-based products in the world, and thus provides a good example of an economic system with high resource dependence. However, the notable advantage of our approach is that it does not depend on the Peak-Oil-vulnerability narrative but is equally useful in a climate change context, for designing policies to reduce carbon dioxide emissions. In that case, one could easily include other fossil fuels such as coal in the model and results could help policy makers to identify which sectors can be controlled and/or managed for a maximum, low-carbon effect, without destabilizing the economy,” Professor Hubacek said.

One of the main ways a Peak Oil vulnerable industry can become less so, the authors say, is for that sector to reduce the structural and financial importance of oil. For example, Hubacek and colleagues note that one approach to reducing the importance of oil to agriculture could be to curbing the strong dependence on artificial fertilizers by promoting organic farming techniques and/or reducing the overall distance travelled by people and goods by fostering local, decentralized food economies.

Peak Oil Background and Impact

The Peak Oil dialogue shifts attention away from discourses on “oil depletion” and “stocks” to focus on declining production rates (flows) of oil, and increasing costs of production. The maximum possible daily flow rate (with a given technology) is what eventually determines the peak; thus, the concept can also be useful in the context of other renewable resources.

Improvements in extraction and refining technologies can influence flows, but this tends to lead to steeper decline curves after the peak is eventually reached. Such steep decline curves have also been observed for shale gas wells.

“Shale developments are, so we believe, largely overrated, because of the huge amounts of financial resources that went into them (danger of bubble) and because of their apparent steep decline rates (shale wells tend to peak fast),” according to Dr. Kerschner.

Go deeper with Bing News on:

Peak Oil

- 'End of oil not in sight', OPEC Secretary General says in MEES article

The end of oil is not in sight, OPEC's top official said, as the pace of energy demand growth means that alternatives cannot replace it at the needed scale, and the focus should be on cutting ...

- Drop in fuel demand and oil prices sends gas prices lower: AAA

The national average cost for a gallon of gas declined to $3.65, a slight two-cent decrease from the previous week. Gas demand fell from 8.66 to 8.42 million barrels per day last week and oil prices ...

- Through Aramco, Peak China courts Peak Oil

Exchanges between China and Arab states stretch back centuries along the ancient Silk Road. More recently, Saudi Aramco is doubling down in the People’s Republic, making energy investments in the ...

- PetroChina: rapid EV uptake means oil consumption for transport to peak by next year ‘at the latest’ in China

Oil consumption in China’s transport sector will peak next year ‘at the latest’ as rapid adoption of electric vehicles (EVs) pulls the plug on petrol consumption, according to the nation’s largest oil ...

- Gas Prices Likely to Keep Falling Ahead of Peak Driving Season

The nationwide average price for a gallon of gasoline on Wednesday was $3.66, down from 3.667 on Tuesday, and the same as a week ago, despite the springtime surge that generally precedes Memorial Day ...

Go deeper with Google Headlines on:

Peak Oil

[google_news title=”” keyword=”Peak Oil” num_posts=”5″ blurb_length=”0″ show_thumb=”left”]

Go deeper with Bing News on:

Global oil production

- OPEC's Next Production Decision Could Be Decided in the UAE

Insiders reveal that ADNOC is considering raising production to around 4.85-4.87 million bpd, breaking from the current OPEC strategy.

- Crude oil prices today: WTI prices are up 1.65% today

What is the current oil price today? WTI futures traded at $84.83 per barrel, as of 9 a.m. ET. Year to date, WTI prices are up by 15.51%. Brent futures traded around $89.56/bbl, an increase of 1.55% ...

- Why ExxonMobil and Chevron Q1 Earnings Are Expected To Fall Despite Rising Oil Prices

A global glut in natural gas supplies and moderately lower gasoline prices will likely more than offset any benefits of surging first-quarter crude oil prices for ExxonMobil and Chevron.

- 20 Countries That Increased Oil Production the Most in A Decade

In this article, we discuss the 20 Countries That Increased Oil Production the Most in A Decade. If you want to skip our discussion of the oil markets, you can go directly to 5 Countries That ...

- Diamondback Energy: Oil Outlook Improving, But Valuation Is Stretched, And Merger May Fail

Diamondback Energy is focused on the Permian Basin for cheap production. Click here to read why I believe FANG stock is slightly overvalued.

Go deeper with Google Headlines on:

Global oil production

[google_news title=”” keyword=”global oil production” num_posts=”5″ blurb_length=”0″ show_thumb=”left”]