They are pivotal in defense technology

Former Chinese president Deng Xiaoping recognized the importance of rare earth elements (REEs) almost two decades ago. “The Middle East has oil and China has rare earth,” he said in 1992. His foresight was impressive.

Today, REEs are used in most high-tech products predominantly in the form of heavy-duty batteries and magnets. They are pivotal in defense technology – lasers, radars and electromagnetic weaponry – as well as green technology. It is therefore not surprising that China’s near monopoly of their production has industry and government worried.

Several governments have begun fast-tracking new policy to increase production. Backroom debates over whether to stockpile the strategic resource have been taking place for several years now, most notably by the US Department of Defense. These debates, prompted by recent Chinese export restrictions, have culminated in the US, European Union and Japan filing a joint case against China to the World Trade Organization – the first such cooperation by the three powers. Yet this official complaint is a latecomer to a dispute that has been playing out for several years in China’s favor.

In rare abundance

The name, rare earth element, is a misnomer. The elements are far more abundant than many precious minerals. Yet their dispersion means they are rarely found in economically viable quantities. There are 17 REEs – 15 lanthanides, and scandium and yttrium. The 15 lanthanide elements occupy atomic numbers 57 to 71 on the periodic table. The similarity of their chemical properties, demonstrated by their close proximity on the table, makes them very difficult to separate. Their extraction is capital- and skill- intensive.

In 2011, the US Geological Survey (USGS) updated its global reserve-estimate data of rare earth elements as it narrowed its definition of recoverable minerals. The result saw reserve estimates in China rise from 36 megatons (Mt) to 55Mt – exactly half of the world’s reserves. US estimates remain at 15Mt; the Commonwealth of Independent States (Russia and former Soviet republics) are reported to have reserves of 19Mt; while estimates of Australia’s reserves declined from 5.4 to 1.6Mt.

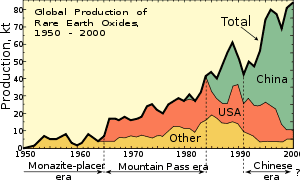

Yet the untapped reserves of the resource mean little; it is the production that counts. And it is China that is a clear leader supplying 95% of world production.

Driving recent policy initiatives is the upsurge of global demand for REEs. According to the USGS, demand is increasing 10% annually. Demand is similarly rising in China – the country’s consumption of the resource has quadrupled since 2000. The growing domestic demand has been cited as the reason for sharp declines in export quotas, cut by 37% in 2010 and 35% cut in the first half of 2011.

China’s near monopoly on production, and its subsequent reductions in exports, have seen prices of REEs increase 10-fold on 2010 per kilo prices. Just as worrying has been China’s predatory pricing, which has run other REE mines and companies out of business, or at least into the red.

The curbing of exports has similarly forced high-tech manufacturers to relocate to China to ensure adequate supply, thereby harming the growth of high-tech industry in many other countries such as Japan, South Korea and Europe. In doing so China appears to be creating a high-tech industry almost overnight.

A strategic resource

End uses for REEs are varied. Figures cited by the USGS noted that in the US in 2009 the distribution of rare earths for end use was largely for chemical catalysts (22%), petroleum refining catalysts (21%), automotive catalytic converters (14%) and approximately 40% was for battery alloys, ceramics and magnets (sectors which are growing 4% to 10% annually).

The extent to which REEs are used in defense technology is such that without their production modern warfare – fighter jets, drones, and most computer controlled equipment – would not be possible. A sovereign production monopoly of such a resource is therefore a serious concern for any nation. The next generation of warfare, in which the US government continues to invest significantly, is heavily dependent on REEs.

via Asian Times Online – Elliot Brennan

The Latest Streaming News: Rare earths updated minute-by-minute

Bookmark this page and come back often

Latest NEWS

Latest VIDEO