CREDIT

P. Klimek, M. Obersteiner, S. Thurner, Systemic trade risk of critical resources. Sci. Adv. e1500522 (2015).

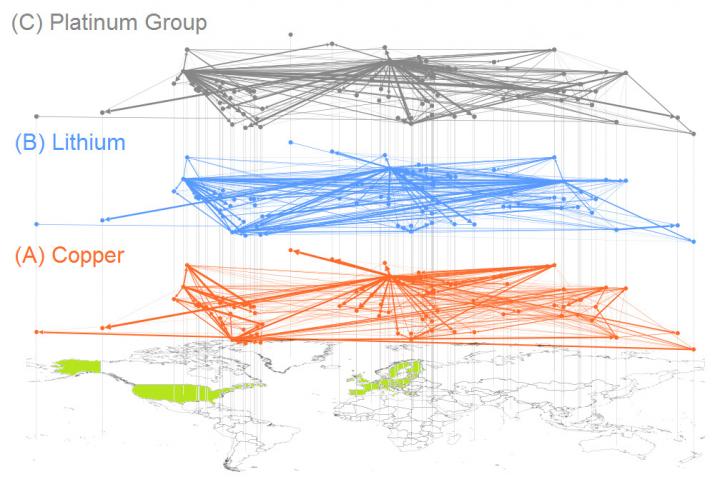

A shortage of a rare mineral could spur global market instabilities, according to a new analysis of international commodity trade networks.

Shortages of natural resources–minerals such as copper, aluminum, and mercury–could lead to cascading shocks and lead to instabilities in the global trade system, according to a study published today in the journal Science Advances.

Mineral resources are increasingly important in the production of modern devices such as mobile phones and medical technologies. These resources are mined and shipped around the world through increasingly interlinked global trade networks.

“Regional shortages of minerals necessary for the manufacture of modern technologies could ripple throughout the trade system, leading to a sharp increase in the price volatility of such minerals in the global markets,” says Peter Klimek, a researcher at the Medical University of Vienna, who led the study in collaboration with IIASA researchers.

The study examined trade flows of 71 mineral commodities between 107 countries, using a new method to assess the systemic risk in commodity trade networks.

It shows that minerals that are produced as a byproducts of other processes–for example rare earth metals produced as a byproduct of phosphorus mining for fertilizer–are the most susceptible to price volatility leading to systemic instabilities,

“The beauty of this methodology is that it allows the data to tell its own story,” says IIASA Ecosystems Services and Management Program Director Michael Obersteiner. The new study grew out of a conversation with IIASA Advanced Systems Analysis researcher Stefan Thurner, who has previously applied similar methods to the study of systemic risk in financial markets.

“Commodity markets, like financial markets, are highly international and interconnected,” explains Thurner. “Understanding these networks gives us a handle to explain and possibly predict a large portion of the instabilities in terms of price volatility in the markets.”

In particular the study finds shortcomings in the management of non-fuel mineral resources that increase the systemic risk, and provides a method for countries to assess their resilience with respect to such rippling network effects. It proposes policy measures, for example a tax based on commodity risk that could create more stable markets.

The researchers plan to continue their collaboration, extending the methodology to explore other networked systems, for example the agriculture system, food trade, and food security.

Read more: Network analysis shows systemic risk in mineral markets

The Latest on: Systemic risk in mineral markets

[google_news title=”” keyword=”systemic risk in mineral markets” num_posts=”10″ blurb_length=”0″ show_thumb=”left”]

via Google News

The Latest on: Systemic risk in mineral markets

- Climate 'poses systemic financial risks'on May 1, 2024 at 5:00 pm

This is what’s called a systemic risk. What’s critical about climate change ... with governments like Britain’s effectively working to prop up the household insurance market by offering insurance to ...

- The stock market has a 'systemic problem'on April 29, 2024 at 7:24 am

"Higher rates are now a systemic problem for equities," Piper Sandler chief investment strategist Michael Kantrowitz wrote in a weekly note to clients on Friday. Kantrowitz pointed to the market ...

- The stock market has a 'systemic problem'on April 29, 2024 at 4:24 am

"Higher rates are now a systemic problem for equities," Piper Sandler chief investment strategist Michael Kantrowitz wrote in a weekly note to clients on Friday. Kantrowitz pointed to the market ...

- News tagged with systemic riskon April 18, 2024 at 5:00 pm

Researchers at the University of California San Diego School of Global Policy and Strategy have developed a new method to predict the financial impacts climate change will have on agriculture ...

- All the natural alternatives to pesticide you'll ever needon April 15, 2024 at 5:00 pm

There's no need to risk disease or spend more money on chemical ... The oil extracted from its root works as a systemic insecticide. Neem oil insecticide works as a systemic in many plants when ...

- China’s stock market: Beijing issues unprecedented guidelines calling for transparency, risk-managementon April 12, 2024 at 10:31 am

China has issued an unprecedented set of policy guidelines to push for transparency, security, risk-management and vibrancy in the country’s US$9 trillion stock market, sketching out a view of ...

- IMF Warns of Cyber Risks to Financial Sectoron April 9, 2024 at 11:30 am

said Felix Suntheim, deputy division chief in the IMF’s monetary and capital markets department.

- Private Credit’s Growth Raises Potential for Systemic Risk, IMF Sayson April 8, 2024 at 11:20 am

“Valuation is infrequent, credit quality isn’t always clear or easy to assess, and it’s hard to understand how systemic risks may be building given the less than clear interconnections ...

- TSLA Option Market Risk Perceptionon March 7, 2024 at 9:05 am

Implied beta measures the options market's perception of a stock's systematic risk or its level of comovement with the aggregate market. High beta values indicate greater sensitivity to broad ...

- How To Minimize Your Losses In The Stock Marketon September 30, 2023 at 2:59 am

I often say the market was set up to fool people. Systemic risk, often known as undiversifiable risk, is another name for market risk. It's the kind of risk that can't be mitigated by spreading ...

via Bing News